Iraq's economy is dominated by the petroleum sector, which has traditionally provided about 95% of foreign exchange earnings. In the 1980s, financial problems caused by massive expenditures in the eight-year war with Iran and damage to oil export facilities by Iran led the government to implement austerity measures, borrow heavily, and later reschedule foreign debt payments; Iraq suffered economic losses of at least $80 billion from the war. After the end of hostilities in 1988, oil exports gradually increased with the construction of new pipelines and restoration of damaged facilities. of Iraq grew 56% in the '60s reaching a peak growth of 57% in the '70s. However, the current GDP per capita shrank by 23% in the '80s amid the Iraq-Iran War.

Economic sanctions of the 1990s[]

Iraq's seizure of Kuwait in August 1990, subsequent international economic sanctions, and damage from military action by an international coalition beginning in January 1991 drastically reduced economic activity. The government's policies of supporting large military and internal security forces and of allocating resources to key supporters of the regime have exacerbated shortages. The implementation of the UN's Oil for Food program in December 1996 has helped improve economic conditions. For the first six six-month phases of the program, Iraq was allowed to export limited amounts of oil in exchange for food, medicine, and other humanitarian goods. In December 1999, the UN Security Council authorized Iraq to export as much oil as required to meet humanitarian needs. Oil exports are now about three-quarters their prewar level. Per capita food imports have increased significantly, while medical supplies and health care services are steadily improving. Per capita output and living standards are still well below the prewar level, but any estimates have a wide range of error.

Iraq's economy is characterized by a heavy dependence on oil exports and an emphasis on development through central planning. Prior to the outbreak of the war with Iran in September 1980, Iraq's economic prospects were bright. Oil production had reached a level of 560,000 m³ (3.5 million barrels) per day, and oil revenues were 21 billion in 1979 and 27 G$ in 1980. At the outbreak of the war, Iraq had amassed an estimated 35 billion in foreign exchange reserves.

The Iran–Iraq War depleted Iraq's foreign exchange reserves, devastated its economy, and left the country saddled with a foreign debt of more than $40 billion. After hostilities ceased, oil exports gradually increased with the construction of new pipelines and the restoration of damaged facilities.

Iraq's invasion of Kuwait in August 1990, subsequent international sanctions, and damage from military action by an international coalition beginning in January 1991 drastically reduced economic activity. Government policies of diverting income to key supporters of the regime while sustaining a large military and internal security force further impaired finances, leaving the average Iraqi citizen facing desperate hardships. Implementation of the UN oil-for-food program in December 1996 improved conditions for the average Iraqi citizen. Since 1999, Iraq was authorized to export unlimited quantities of oil to finance humanitarian needs including food, medicine, and infrastructure repair parts. Oil exports fluctuate as the regime alternately starts and stops exports, but, in general, oil exports have now reached three-quarters of their pre-Gulf War levels; per capital output and living standards remain well below pre-Gulf War levels.

The economic sanctions were fully lifted in 24 May 2003, shortly after Saddam Hussein was overthrown. This resulted in economic growth of 53% topping the list of the world's fastest growing economy.

Sanctions[]

Iraq's seizure of Kuwait in August 1990, subsequent international economic sanctions, and damage from the ensuing Gulf War of 1991 drastically reduced economic activity. Although government policies supporting large military and internal security forces and allocating resources to key supporters of the Ba'ath Party government hurt the economy, implementation of the United Nations' corruption-plagued oil-for-food program in December 1996 was to have improved conditions for the average Iraqi citizen. In December 1999, the UN Security Council authorised Iraq to export under the program as much oil as required to meet humanitarian needs. Iraq changed its oil reserve currency from the US dollar to the euro in 2000. Oil exports were more than three-quarters of the pre-war level. However, 28% of Iraq's export revenues under the program were deducted to meet UN Compensation Fund and UN administrative expenses. The drop in GDP in 2001 was largely the result of the global economic slowdown and lower oil prices. Following the 2003 invasion of Iraq, the economy to a great extent shut down; attempts are underway to revive it from the damages of war and rampant crime.

After the Fall of Saddam Hussein[]

Since the peak of 1980, the nominal GDP of Iraq has steadily shrunk to merely $12.3 billion in 2000. However removal of sanctions, after the overthrow of Saddam, had immediate effect. The nominal GDP had reached $55.4 billion by 2007 due to increase in oil output as well as international prices. In 2006, the real GDP growth was estimated at almost 17 percent.

Paul Bremer, chief executive of Iraq, planned to restructure Iraq's state owned economy with free market thinking. Order 39 laid out the framework for full privatization in Iraq, except for "primary extraction and initial processing" of oil, and permitted 100% foreign ownership of Iraqi assets. Paul Bremer also ordered a flat tax rate of 15% and allowed foreign corporations to repatriate all profits earned in Iraq. Opposition from senior Iraqi officials, together with the poor security situation, meant that Bremer's privatization plan was not implemented during his tenure, though his orders remain in place. In addition to approximately 200 other state owned businesses, privatization of the oil industry was scheduled to begin sometime in late 2005, though it is opposed by the Federation of Oil Unions in Iraq.

Business storefront signs in downtown Baghdad, Iraq in April 2005.Bremer's transitional government featured figures close to the George W. Bush administration, such as grain-trading industry lobbyist Dan Amstutz, who was put in charge of agricultural policy in Iraq.

One of the key economic challenges was Iraq's immense foreign debt, estimated at $125 billion. Although some of this debt was derived from normal export contracts that Iraq had failed to pay for, some was a result of military and financial support during Iraq's war with Iran.

The Jubilee Iraq campaign argued that much of these debts were odious (illegitimate). However, as the concept of odious debt is not accepted, trying to deal with the debt on those terms would have embroiled Iraq in legal disputes for years. Iraq decided to deal with its debt more pragmatically and approached the Paris Club of official creditors.

In a December 2006 Newsweek International article, a study by Global Insight in London was reported to show "that Civil war or not, Iraq has an economy, and—mother of all surprises—it's doing remarkably well. Real estate is booming. Construction, retail and wholesale trade sectors are healthy, too, according to the in report. The U.S. Chamber of Commerce reports 34,000 registered companies in Iraq, up from 8,000 three years ago. Sales of secondhand cars, televisions and mobile phones have all risen sharply. Estimates vary, but one from Global Insight puts GDP growth at 17 percent last year and projects 13 percent for 2006. The World Bank has it lower: at 4 percent this year. But, given all the attention paid to deteriorating security, the startling fact is that Iraq is growing at all."

Between 100,000 barrels per day (16,000 m³/d) and 300,000 barrels per day (48,000 m³/d) of Iraq’s declared oil production over the past four years could have been siphoned off through corruption or smuggling, according to a US Study from May 12, 2007.[7]

National quality mark of Iraq

Opportunity Cost of Conflict[]

A report by a political think tank based in Mumbai, India has calculated the peace dividend for the Middle East and consequently the economic cost of conflict in the region by country. According to the report, the opportunity cost of conflict for the region from 1991-2010 has been a whopping $12 trillion (12,000,000,000).Iraq has suffered the largest loss. Its GDP could have been more than 30 times its present size. If we measure Iraq's oopportunity loss since 1980, before the Iran Iraq war and the Persian Gulf War with Kuwait, the losses are even greater - Iraq's GDP could have been more than 50 times its projected GDP in 2010. In other words, had there been peace in Iraq, every Iraqi citizen would be earning over $9,600 instead of the $2,300 in 2010.

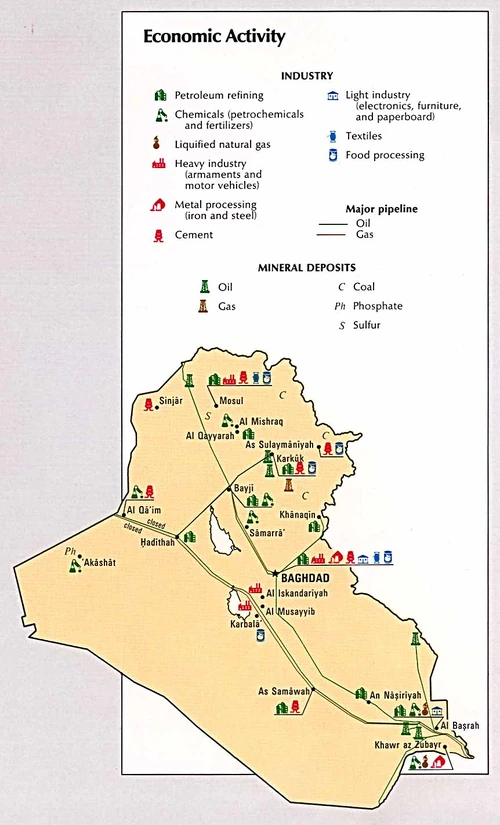

Industry[]

Traditionally, Iraq’s manufacturing activity has been closely connected to the oil industry. The major industries in that category have been petroleum refining and the manufacture of chemicals and fertilizers. Before 2003, diversification was hindered by limitations on privatization and the effects of the international sanctions of the 1990s. Since 2003, security problems have blocked efforts to establish new enterprises. The construction industry is an exception; in 2000 cement was the only major industrial product not based on hydrocarbons. The construction industry has profited from the need to rebuild after Iraq’s several wars. In the 1990s, the industry benefited from government funding of extensive infrastructure and housing projects and elaborate palace complexes.

Primary sectors[]

Agriculture[]

Historically, 50 to 60 percent of Iraq’s arable land has been under cultivation. Because of ethnic politics, valuable farmland in Kurdish territory has not contributed to the national economy, and inconsistent agricultural policies under Saddam Hussein discouraged domestic market production. Despite its abundant land and water resources, Iraq is a net food importer. Under the UN Oil for Food program, Iraq imported large quantities of grains, meat, poultry, and dairy products. The government abolished its farm collectivization program in 1981, allowing a greater role for private enterprise in agriculture.

The international Oil-for-Food program (1997–2003) further reduced farm production by supplying artificially priced foreign foodstuffs. The military action of 2003 did little damage to Iraqi agriculture; because of favorable weather conditions, in that year grain production was 22 percent higher than in 2002. Although growth continued in 2004, experts predicted that Iraq will be an importer of agricultural products for the foreseeable future. Long-term plans call for investment in agricultural machinery and materials and more prolific crop varieties—improvements that did not reach Iraq’s farmers under the Hussein regime. In 2004 the main agricultural crops were wheat, barley, corn, rice, vegetables, dates, and cotton, and the main livestock outputs were cattle and sheep.

The Agricultural Cooperative Bank, capitalized at nearly 1 G$ - by 1984, targets its low-interest, low-collateral loans to private farmers for mechanization, poultry projects, and orchard development. Large modern cattle, dairy, and poultry farms are under construction. Obstacles to agricultural development include labour shortages, inadequate management and maintenance, salinization, urban migration, and dislocations resulting from previous land reform and collectivization programs.

Importation of foreign workers and increased entry of women into traditionally male labour roles have helped compensate for agricultural and industrial labour shortages exacerbated by the war. A disastrous attempt to drain the southern marshes and introduce irrigated farming to this region merely destroyed a natural food producing area, while concentration of salts and minerals in the soil due to the draining left the land unsuitable for agriculture.

Forestry, fishing, and mining[]

Throughout the twentieth century, human exploitation, shifting agriculture, forest fires, and uncontrolled grazing denuded large areas of Iraq’s natural forests, which in 2005 are almost exclusively confined to the northeastern highlands. Most of the trees found in that region are not suitable for lumbering. In 2002 a total of 112,000 cubic meters of wood were harvested, nearly half of which was used as fuel.

Despite its many rivers, Iraq’s fishing industry has remained relatively small and based largely on marine species in the Persian Gulf. In 2001 the catch was 22,800 tons.

Aside from hydrocarbons, Iraq’s mining industry has been confined to extraction of relatively small amounts of phosphates (at Akashat), salt, and sulfur (near Mosul). Since an awesome productive period in the 1970s, the mining industry has been hampered by the Iran–Iraq War (1980–88), the sanctions of the 1990s, and the economic collapse of 2003.

Energy[]

As one of the three most oil-rich countries in the world, Iraq has the resources for complete energy independence. By world standards, production costs for Iraqi oil are relatively low. However, three wars (Iraq-Iran War from 1980-1988, Gulf War 1991 and the Iraqi Invasion of 2003) in addition to the UN sanctions - which lasted for twelve years from 1991 to 2003, left the industry’s infrastructure in poor condition. The lifting of sanctions in 2003 allowed repairs to begin. However, since 2003 oil pipelines and installations have been sabotaged persistently. In 2004 Iraq had eight oil refineries, the largest of which were at Baiji, Basra, and Daura. Sabotage and technical problems at the refineries forced Iraq to import fuels, liquid petroleum gas, and other refined products from nearby countries. In October 2004, for example, Iraq spent US$60 million for imported gasoline. In late 2004 and early 2005, regular sabotage of plants and pipelines reduced export and domestic distribution of oil, particularly to Baghdad. Nationwide fuel shortages and power outages resulted.

In 2004 plans called for increased domestic utilization of natural gas to replace oil and for use in the petrochemical industry. However, because most of Iraq’s gas output is associated with oil, output growth depends on developments in the oil industry.

As much as 90 percent of Iraq’s power generating and distribution systems were destroyed in the Persian Gulf War of 1991, and full recovery never occurred. In mid-2004, Iraq had an estimated 5,000 megawatts of power-generating capacity, compared with 7,500 megawatts of demand. At that time, the transmission system included 17,700 kilometers of line. In 2004 plans called for construction of two new power plants and restoration of existing plants and transmission lines to ease the blackouts and economic hardship caused by this shortfall, but sabotage and looting held capacity below 6,000 megawatts. In 2004 the World Bank estimated that US$12 billion would be needed for near-term restoration, and the Ministry of Electricity estimated that US$35 billion would be necessary to rebuild the system fully.

In 2007, hydrocarbon industries accounted for well over 70 per cent of the Iraqi economy and 95 per cent of the government's revenues. Diversification of the economy into non-hydrocarbon industries remain a long-term issue.

Services[]

Finance[]

Iraq’s financial services have been the subject of post-Hussein reforms. The 17 private banks established during the 1990s were limited to domestic transactions and attracted few private depositors. Those banks and two main state banks were badly damaged by the international embargo of the 1990s. To further privatize and expand the system, in 2003 the Coalition Provisional Authority removed restrictions on international bank transactions and freed the Central Bank of Iraq (CBI) from government control. In its first year of independent operation, the CBI received credit for limiting Iraq’s inflation. In 2004 three foreign banks received licenses to do business in Iraq.

Private Security[]

Because of the danger posed by Iraq’s ongoing insurgency, the security industry has been a uniquely prosperous part of the services sector. Often run by former U.S. military personnel, in 2005 at least 26 companies offered personal and institutional protection, surveillance, and other forms of security.

Retail[]

In the early post-Hussein period, a freewheeling retail trade in all types of commodities straddled the line between legitimate and illegitimate commerce, taking advantage of the lack of income tax and import controls.

[edit] Tourism

The Iraqi tourism industry, which in peaceful times has profited from Iraq’s many places of cultural interest (earning US$14 million in 2001), has been completely dormant since 2003. Despite conditions, in 2005 the Iraqi Tourism Board maintained a staff of 2,500 and 14 regional offices.

[edit] Telecommunications

During 2003-8, mobile phone subscriptions had expanded over hundredfold to 10 million nationwide, reported the Brookings Institute.[9]